Help your Kids to be Wealthier than You!

We all want the best for our children, as we help them every day to build up their social skills, develop relationships, maximise their education opportunities and most of all be happy children! We can also help them in a financial sense too. Below first of all are a few valuable lessons you can teach them about managing money, followed by two ways you can ensure they receive money from you more tax efficiently. Hopefully these will all help them have a healthy relationship with money into the future!

Teach your children about saving

Show your children the benefit of saving small amounts of money each week out of their pocket money. The old adage of “Look after the pennies and the pounds will look after themselves” stood us all in good stead over the years.

This teaches children that they cannot have everything they want on demand, and that by being patient and saving a few bob, they then get to enjoy more expensive toys / games / clothes than they could otherwise buy. They also tend to become more tuned in to making sure they aren’t just frittering their money away.

Teach them to be wary of borrowing

Borrowing money is a part of life and often makes good financial sense. Getting a mortgage to buy a home or even a loan for a car are often necessary. However borrowing money simply to support a lifestyle you cannot afford is a recipe for disaster.

Credit cards can feel cool to children! That is until they get their bill and suddenly realise the rates of interest being charged… Children should be taught about the dangers of credit cards in particular and loans in general, and that they are only suitable as part of a structured financial plan.

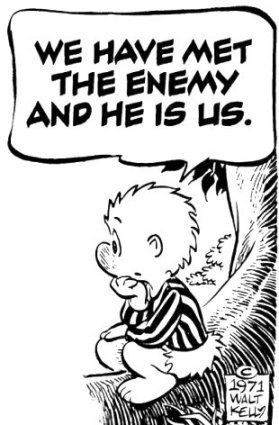

Educate them in your own financial errors.

Unfortunately we’ve all made financial mistakes over the years. Maybe too much property in the boom, maybe we didn’t get proper independent financial advice early enough in our lives. Tell your children about lessons you’ve learned and how they can avoid making these same ones themselves.

Give money to them in a tax efficient way

One of the impacts of the economic crisis was a slashing of the amount of money that could pass tax free from a parent to a child either as a gift or as an inheritance on death. In the good old days, a parent could gift more than €500,000 to a child before any tax applied. However this lifetime tax-free threshold now stands at only €280,000.

Should you be in the fortunate position to help your child buy a house for example by gifting them money, the amount you give them will be set against the threshold. This will mean that at a late stage, such as when they inherit from you on your death, their tax bill will be bigger as they will have used up much of their threshold.

The answer may lie in how you gift the money to a child. Rather than giving your child a large sum of money in any one year that is offset against their lifetime threshold, it is more efficient to gift them a smaller amount of money each year. There is a “small gift exemption” that allows any individual to gift up to €3,000 to any other individual each year without impacting the lifetime threshold at all.

So two parents can gift €6,000 to each of their children each year tax free, and without impacting the lifetime threshold. So if you started this at birth, your child could enjoy the fruits of your savings of €120,000 (plus all growth on this) at age 20 without any tax implications. Now there’s a nice start to their adult lives!

Life assurance can help too

Even without gifts prior to death, these lower thresholds are causing problems for many families that are inheriting money from parents. Many families are facing sizeable inheritance tax bills, as a tax rate of 33% is applied to the inheritances received by individuals above the threshold. This has resulted in many family homes having to be sold by beneficiaries when they would have preferred to keep it, just in order to generate cash to pay the tax bill.

Life assurance is one of the best solutions to deal with this issue. In fact there is a specific type of policy (a section 72 life assurance policy) for this purpose. A section 72 policy does not form part of the estate, instead its purpose is solely to pay the inheritance tax liability. The premiums can be paid either by the parents or by the future beneficiaries. Having this cover in place should ensure that a tax bill won’t decide whether inherited assets can be retained or not.

If you can teach your kids a few valuable lessons about money and maximise the amount of money they will receive from you during your life and on death, there’s every chance they will end up wealthier than you one day!